- MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 PROFESSIONAL

- MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 DOWNLOAD

All examples are hypothetical and are for illustrative purposes. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. Step one work out how much income you might need in retirement Essential expenditure this is money you need to cover your basic living needs, such as. 9+ Retirement Budget Templates 1.The American Institute of Certified Public Accountants In addition to that, it is natural for your whims to change with time which will also lead to a change of plans which will end up in you altering the existing budget. Since life itself is unpredictable, you will have to make changes to the budget constantly.

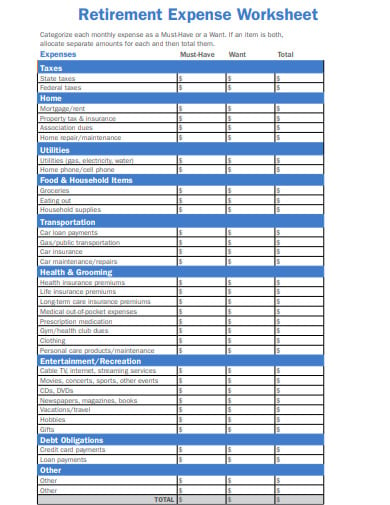

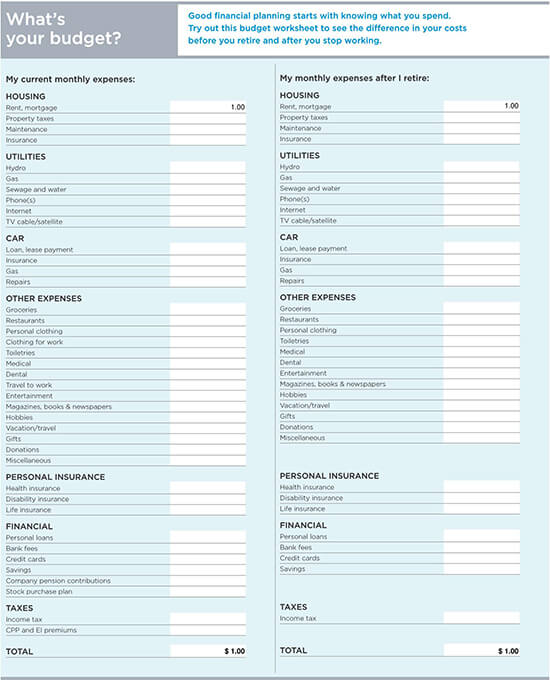

Besides the fundamental fixed costs, retired people should plan and financial plan for charges, any expected estates, amusement and travel and startling costs, alluded to as shocks, that can’t be precisely assessed. This step is the most important one if you really want to follow the budget. These essential requirements represent 79 of the pay of single retired folks ages 53 to 64. Find the budget worksheet that you can adapt to include all your expenses. Some of them have extra options such as pet care and vacation savings. Some people wish to move to the countryside while some wish to reside amid the buzz of the city, so depending on the locality, your expenses might go up or down. Budget Worksheets Most budget worksheets have spaces for you to enter rent or mortgage, utilities, food, clothing and so forth.

MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 DOWNLOAD

Your retirement plans affect the budget so certain adjustments will have to be made by looking at your wishes and hobbies you are going to follow. Download or print a copy of the Retirement Income and Expenses Worksheet below to help you estimate the monthly income and expenses you expect to have in. This section can be cut down to adjust the whole budget if any additional expenses come up situationally. Remember to cover the important expenses before deciding on this step. The cost of these must be checked before adding them to the budget. Step two work out your likely retirement income. You can use this form if you are age 65 or older at the end of 2022. These include vacation plans, spa service expenses, plans to surprise someone, etc. Step one work out how much income you might need in retirement. See Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments.

You can create a worksheet using a pen and paper, an Excel spreadsheet or a Google. Step 3: Include Optional ActivitiesĪctivities or services which are not a part of your daily life falls under this category. A retirement budget worksheet can be as high- or low-tech as youd like. The expenses that this service requires needs special attention as your health is of prime importance. You will have to take charge and pick up a plan that suits your lifestyle. But when you are retired, this doesn’t happen. Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20 rule. There are high chances that your health insurance was maintained by the bank which handles your salary. When he retires, he has decided to plan for a 25-year retirement.

Therefore, although it isn’t compulsory to divide the expenses are essential and non-essential, doing so will make it easier. 2, United States Navy Personal Financial Management (PFM) Education, Training. The expenses that aren’t essential can be adjusted to stretch your budget and fit in all your needs. These essential expenses should always get the top priority in your retirement budget. There are some expenses that have grown to become a vital part of your life.

MONTHLY BUDGET PLANNING WORKSHEET FOR RETIREMENT AT 65 PROFESSIONAL

Professional Retirement Budget Templateĥ Steps to Create a Retirement Budget Step 1: Note Down Your Fixed Expenses

0 kommentar(er)

0 kommentar(er)